OVERVIEW

In the digital age, data sharing has emerged as a cornerstone of modern financial ecosystems, enabling a myriad of benefits for consumers, businesses, and regulatory bodies.

As financial transactions and interactions increasingly occur online, the ability to share data seamlessly and securely becomes paramount. Data sharing facilitates enhanced risk management, personalized financial services, and robust fraud detection mechanisms, contributing to a more transparent and efficient financial landscape.

The digitization of financial services has democratized access to financial data, empowering consumers with greater control over their financial information. This transparency fosters trust and enables consumers to make informed financial decisions, ultimately promoting financial literacy and inclusion. Furthermore, data sharing drives innovation by allowing fintech companies to leverage comprehensive datasets to develop innovative products and services tailored to the unique needs of different consumer segments.

The Indian financial sector is on a transformative journey. Technological advancements are reshaping how financial institutions operate, and data is at the heart of this revolution. By leveraging user data, institutions can personalize services, assess risk profiles more accurately, and offer innovative financial products.

This data-driven approach hinges on a critical factor – user trust

In a landscape where financial information is highly sensitive, striking a balance between data utility and user privacy becomes paramount.

This report delves into the user experience with data sharing practices employed by Indian financial institutions. Drawing on a user survey conducted by Silence Laboratories, the report explores the delicate interplay between transparency, control, and user comfort with data sharing. It sheds light on the current state of affairs, unveils user expectations, and proposes solutions to bridge the gap between what is being communicated and how users perceive their control over their financial data.

REPORT HIGHLIGHTS

In India, privacy challenges are complex due to multiple reasons.

LOW LITERACY

in Cyber Risk Literacy Index

States with lower Foundational Literacy Scores

have higher cybercrimes

REGULATORY LAG

Cybersecurity regulatory frameworks falls 40.5x behind high-tech innovators’ infra

INEFFECTIVE CONSENT

Low clarity & control over granular aspects of data sharing terms

Lack of transparency and auditability

All of these problems create a false sense of safety & comfort

High trust in financial institutions and consent based data sharing

Poor risk perception and enhanced

vulnerabilities

Gap between the perceived privacy levels and on ground reality

There is no one stop solution to address the complex privacy challenges.

EDUCATION

Efforts to educate & inform customers about their rights & resources will play a huge role in addressing privacy challenges. However, this requires a long-term timeline to see noticeable impact.

PLACING TRUST IN TECH OVER LEGAL CONTRACTS

Preventing movement or exposure of data and collaborating on inferences to build a foolproof infrastructure that eliminates any risk of misuse or breaches.

Transparency, programmability and auditability to bind data processing with policy, governance and consent.

SURVEY OVERVIEW

The opacity surrounding data collection practices, the lack of user control over how their data is used, and the potential for misuse all contribute to a growing sense of unease amongst users.

Quest for Transparency and Control

The user survey exposes deficiencies in the current state of data sharing practices of Indian financial institutions. While a significant portion of users (80.4%) believe institutions are transparent regarding data sharing, there is a crucial disconnect.

6 terms of data sharing

Purpose of data collection

Duration of data storage

Frequency of data access (or refresh)

Specific data points collected

Parties with whom data might be shared

Options for revoking consent

While most users do not seem to be alarmed by such deficiencies, implementing better controls would lead to higher user satisfaction. A resounding 86.7% of users express a desire for granular control over data sharing, split roughly equally between document level control & data point level control. This disconnect between the desired level of control and the current reality is a cause for concern.

Document level control: Willingness to select the document type (for example - bank statements, Investment statements etc.) to be shared

Datapoint level control: Willingness to share specific elements within a document (such as total balances/credits/debits)

16 out of 20 people (80.4%) think that institutions are transparent about data sharing.

Only 1 out of 20 people (6.6%) actually have control over all aspects of data sharing.

The Comfort Spectrum: Privacy vs. Benefits

The user survey reveals a fascinating spectrum of comfort levels regarding data privacy, with a majority of users being open to sharing data in some way or the other.

Users value clear benefits and are more likely to share data if they understand how it translates to demonstrably improved financial products and services. This finding suggests a potential path forward – a future where informed users are empowered to make conscious choices about their data in exchange for demonstrably valuable services.

Building Trust Through Informed Consent

The report underscores the critical role of user consent in building trust.

ASSURANCE IN CONSENT MECHANISMS

70.5%

70.5% users are assured of their privacy if sharing data via formal consent mechanisms

While some progress has been made in terms of transparency around data sharing, there's a significant gap between what users are told and the control they feel they have over their data. This disconnect, coupled with user concerns about privacy and data minimization, necessitates a paradigm shift in how Indian financial institutions approach data sharing.

When users understand how their data is being used and have a choice in the matter, they feel more secure about their privacy.

CONTEXT

Global data regulations are converging on key principles like user consent, data security, and subject rights, while diverging on specifics like localization and exemptions.

At the same time, open banking is driving financial innovation worldwide.

Overview of Global Regulatory Context

Various countries & regions have implemented regulations aimed at protecting user data & fostering trust in the digital ecosystem, all of which comply with a core set of values.

Lawfulness, fairness, & transparency

Purpose limitation

Data minimization

Accuracy

Storage limitation

Integrity and confidentiality

Accountability

Overview of Regulatory Milestones in India

An overview of the key steps leading up to the DPDPA

Key Opportunities and Challenges Presented by the Digital Personal Data Protection Act of 2023

India's digital data landscape is undergoing a significant transformation with the recent introduction of the Digital Personal Data Protection Act (DPDPA) of 2023. This legislation aims to establish a framework for handling digital personal data, including user data shared for financial purposes.

The DPDPA enforces stricter user consent for data processing. Financial institutions that rely on user data for credit scoring, fraud prevention, or personalized financial products will need to obtain clear, verifiable consent from users before collecting or processing their data. This empowers users with greater control over their financial information and fosters trust within the financial ecosystem.

Lacks explicit definition of meaningful consent

Vague or pre-checked consent boxes could still disadvantage users, potentially hindering their ability to make informed choices about data sharing.

Lacks transparency for international transfers

The DPDPA loosens restrictions on transferring data to certain government-approved countries. The criteria for approval however remains undisclosed by the Data Protection Board.

Prioritizes user control over security measures

Even with user consent, data breaches can still occur if information security practices by financial institutions remain weak.

Only regulates digitally collected information

Personal information is often collected through physical forms or interactions. Without clear guidelines for offline data, effectiveness across touchpoints remains limited.

Exemptions for government agencies

Exemptions can potentially be misused to access user data without proper oversight. This lack of transparency discourages users from sharing financial information electronically.

Evolution of Data Sharing Practices

Historically, data sharing was limited to within individual institutions or between regulated entities for specific purposes like creditworthiness assessments.

The introduction of regulations like EU's PSD2, UK's open banking initiative and RBI’s Account Aggregator Framework in India enabled data sharing through standardized APIs.

The development of global frameworks and technologies has further standardized and broadened data sharing practices.

Why is Data Sharing important?

Data sharing enhances transparency and trust among consumers and financial institutions, facilitating better financial decision-making.

It supports financial inclusion by enabling access to credit for underserved populations, boosting economic growth, and reducing poverty levels.

Facilitates innovation in financial products and services by allowing fintech companies to leverage data for developing customized solutions.

Current Landscape of Financial Data Sharing

Open Banking

Open banking refers to the practice of allowing third-party financial service providers access to consumer banking, transaction, and other financial data through APIs.

Open Finance

Open finance expands this concept to include a wider range of financial products beyond banking, such as investments, pensions, and insurance.

Open Data

Rest of the data, Retail, transit, social media, health.

Global Adoption of Open Banking/Open Finance

SOURCE: Basel Commitee Member Survey (BCBS), 2024

Comparison among country profiles

Australia

Regulator driven

Centralised through NPP

Decentralised

Multilateral

Voluntary use

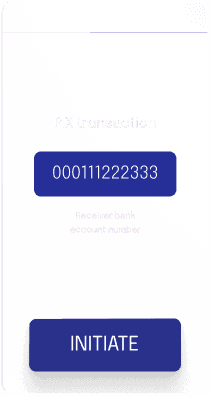

Brazil

Regulator driven

Centralised through Pix

Decentralised

Multilateral

Mandatory use

India

Hybrid

Centralised through UPI

Centralised

Multilateral

Voluntary use with strong encouragement

Mexico

Regulator driven

In development

In development

May involve a centralised API hub

Open banking opens competition

Specialist providers are challenging the service of large banks in core areas such as payments, personal banking, & even business banking.

UNBUNDLING OF PERSONAL BANKING

UNBUNDLING OF BUSINESS BANKING

Due to ease of data & context sharing, providers are able to collaborate and build bigger partnerships.

PARTNERSHIPS

Fintech product offerings have also expanded over time, with open banking allowing providers to offer more personalised services.

Lending

Debit Cards

Checking Accounts

Business Services

Stock Trading

Loan Offerings

Small Business Lending

Credit Monitoring

Financial Inclusion

Through data sharing enabled by open banking systems, number of mobile money accounts has seen a meteoric growth propelling financial inclusion.

2001

17 years

to onboard the

first 1B users

2017

2022

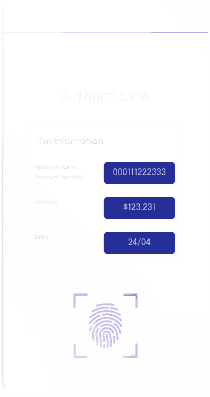

Types of consent mechanisms

When analyzing user data sharing practices, it's essential to understand the various types of consent mechanisms available in the market. These mechanisms form the foundation of how data sharing occurs, providing context on the methods used to obtain user consent and the extent of user awareness and control.

HISTORICAL CONTEXT

Consent management initially focused on healthcare, enabling patients to control access to their protected health information (PHI) and affirm participation in e-health initiatives.

EVOLUTION AND BROADER APPLICATION

With the advent of GDPR, consent management expanded to include private information access by various providers (e.g., online advertisers), reflecting similar consent mechanisms in both healthcare and the broader digital landscape as the same logical imperatives were relevant in the digital realm.

Frequently

Opt-in

Informed

Layered

Explicit

These consent mechanisms are highly prevalent, especially in regions with stringent data privacy regulations and industries handling sensitive information, such as finance and healthcare.

Moderately

Opt-out

Revocable

Implied

These mechanisms are commonly used where explicit consent is less practical or where the focus is on maximizing user participation without overwhelming them with too many choices.

Rarely

Broad

Granular

Broad consent is less common, typically seen in research settings where the future use of data may not be fully determined at the time of collection. It is less favored in commercial settings.

While consent lies at the heart of privacy regulations, the report explores the effectiveness of such mechanisms in delivering what they promise, and the need to redesign consent from a privacy perspective

SURVEY FINDINGS

This section presents the key findings of the research survey investigating user perceptions of data sharing practices employed by Indian financial institutions. The analysis is based on data collected from a sample of 1,520 respondents, adhering to the outlined methodology and focusing on the research objectives:

1

Assess user clarity and understanding of data collection practices in the Indian financial sector.

2

Evaluate user comfort levels with the types of data financial institutions collect and how it is used.

3

Analyze user preferences regarding control over data sharing, including consent mechanisms.

4

Investigate the relationship between user trust in financial institutions and their willingness to share data.

User Clarity and Understanding

Overall Clarity: While a significant portion of users (80.4%) reported feeling somewhat or very clear about the general terms of data sharing by financial institutions, the survey revealed a concerning gap in specific details.

Limited Transparency: While 69.7% respondents were clearly communicated the purpose of data collection, other crucial aspects such as the option to revoke the consent were cited as the least clear terms while giving consent to share their data.

Satisfaction: Even though the users initially felt informed about data sharing terms, deep diving into the specifics potentially puts things in perspective, and when later asked about the clarity and transparency of the consent experience, only 67.2% felt satisfied with the process.

What specific parameters of consent were you clearly able to find & understand?

Takeaways

These findings highlight a need for financial institutions to move beyond generic consent forms and prioritize clear communication about specific data practices. Customers need to be made aware of their rights, and consent requests should include all the key terms of data fetch in an easy to read format.

Furthermore, just as important as clear communication is the timing and placement of the consent terms, for example - even though a consent revocation would happen at a later stage, communicating the option to revoke while giving the consent makes the customers aware of their rights.

User Comfort Levels with Data Sharing

Spectrum of Comfort: The survey revealed a fascinating range of user comfort levels with data sharing. While a significant segment (38.8%) prioritized data minimization and only shared the absolute essentials ("Minimalists"), another sizeable group (42.0%) emerged as "Conditional Sharers," open to sharing some data for demonstrably personalized benefits.

Concerns Regarding Data Collection:

73.5%

users felt financial institutions collect more data than demonstrably needed, raising concerns about data minimization practices. Furthermore, the concerns could be heightened by the lack of awareness of the organisations who get access to customer’s data.

52.9%

customers think account aggregators/consent managers too have access to their financial data, whereas account aggregators are inherently data blind. While customers might trust traditional banking institutions, lack of awareness about who accesses the data and limited trust in newer fintechs or NBFCs may lead to customer concerns.

Privacy vs. Benefits Trade-off: Interestingly, despite privacy concerns, a majority (65.7%) were willing to share data for clear and demonstrably valuable benefits, highlighting the potential for user-centric data sharing models.

Spectrum of comfort regarding data privacy

User Preferences for Control Mechanisms

Limited Control Over Existing Data: Similar to the trends in clarity of terms of data sharing, users generally find themselves unable to control some of them, with <45% of them being able to modify the frequency of data access, parties who get access to this data and options for revoking consent.

Desire for Granular Control: In terms of the specificity of the data that is shared with a financial institution, a resounding 86.7% of respondents expressed a strong preference for having at least a document level control. Roughly half of these would in fact want to dive a level further deeper to select the specific data fields which they’d want to share with financial institutions. This finding emphasizes the need for financial institutions to design consent forms that offer granular control options.

Level of Satisfaction: When looking at the level of content across different aspects of the consent process, the satisfaction score for the control aspect of consent (68.4%) is rated lower than ease of navigation & trustworthiness / security. This clearly indicates control as a major pain point of the users when navigating the consent journey, and implies customer empowerment via data control as a tool to increase customer satisfaction.

Trust and Willingness to Share Data

The Role of Consent: Users have assurance in sharing their financial data if formal consent mechanisms are used, highlighting the power of informed consent in building trust and empowering users.

Understanding of privacy: Users also seem to associate privacy with security measures and consent mechanisms. When asked about their best understanding of privacy, strong security practices to prevent unauthorized access ranked highest with 29.1% respondents choosing this option, closely followed by clear consent mechanisms (27.0%).

What is your best understanding of privacy?

This misdirected association possibly instills a false sense of assurance when sharing data with proper consent and security practices. However, users need to be made aware that privacy can’t be guaranteed even with the existence of these practices.

Is User Confidence in Data Sharing & Security Justified?

Data Breaches: The Next Big Threat to Business

83%

of organizations faced more than one data breach in 2022

13.5%

higher audit fees for breached companies

$5.4B

mean market cap loss for publicly traded companies after a data breach

$4.35M

Global average cost of a data breach in 2022

IBM

80%

of impacted consumers are likely to stop doing business with a company after a cyberattack

$9.5Tr

expected losses due to cyber crime in 2024

Case Study: Estonia

Estonia faced a major cyberattack in 2007 despite being a leader in digital governance. DDoS attacks targeted critical infrastructure, including banks, government websites, and media outlets. The attacks were largely attributed to Russian cyber forces.

Paralyzed digital infrastructure

Catalyzed a shift in cybersecurity posture

Widespread disruption

Accelerated investments in cybersecurity infrastructure and human capital

Financial losses

Established the Cyber Emergency Response Team (CERT-EE)

Reputation damage as a secure digital nation

Enhanced international cooperation

The cyberattack highlighted the need for robust cybersecurity measures, technology, human capital, and international collaboration, even for digitally advanced nations.

>70%

of users feel secure about sharing data with financial institutions

1.3M+

cyber-attacks reported in the financial sector, with over 7,400 Crore INR in losses

How can user confidence be so high when the actual digital landscape is seeing an alarming rise in risks

UNDERSTANDING THE GAPS

The first edition of the Index ranks 50 geographies, including the European Union as a population-weighted aggregate of our ranked EU geographies. The Index, developed through consultations with policy, industry, and academic experts, leverages 42 aggregated indicators across 32 objectives that contribute to scoring 9 “pillars” of cyber risk literacy and education.

They in turn fall under five key drivers of cyber risk literacy and education:

Public motivation

Measures the population’s commitment to practicing cybersecurity, including metrics such as the rate of adherence to specific safe cyber practices

Government policy

Evaluates government policies to improve cyber risk literacy and education, including evaluation of metrics that assess the geography’s national cybersecurity strategy.

Educational system

Measures the extent to which cyber risk instruction is encouraged or mandated, includes metrics that assess primary and secondary school curricula;

Labor market

Measures the degree to which employers drive demand for cyber literacy skills, including metrics such as the uptake of cybersecurity-related roles and the number of cybersecurity startups

Population inclusivity

Measures degree of equal access to digital technologies and formal education in a geography, including metrics such as Internet access and school completion rates.

Unveiling Blind Spots in Indian User Awareness:

Perception vs. Reality in Financial Data Sharing

State/UT wise details of Citizen Financial Cyber Fraud Reporting Management System during the period 1.1.2023 to 31.12.2023

This was stated by the Minister of State for Home Affairs, Shri Ajay Kumar Mishra in a written reply to a question in the Lok Sabha. View press release

Inferences from Comparative Study: Survey Insights vs Cybercrime Stats

User Confidence

Rooted in trust built by legacy institutions over time

Based on brand value and perceived reliability of institutions with a long history of customer service

Emerging Issues

Increasing incidents of cyber financial crimes

Trust may be misplaced or overly optimistic

Users remain unaware of contemporary risks despite digital growth benefits

Necessary Actions

Identify and address factors contributing to the disparity between perception and reality

Enhance user awareness

Improve institutional accountability

Cyber Risk Literacy and Cyber Risk Awareness Across India: A Comparative Analysis of FLN Scores and Reported Cyber financial Crimes

In this section, we will explore how consumer perception and awareness, correlated with foundational literacy scores, demonstrate that higher literacy reduces vulnerability to cybercrime.They in turn fall under five key drivers of cyber risk literacy and education:

Why FLN Scores?

Public Motivation & Education System

Cyber risk literacy is deeply tied to public motivation and the education system.

A strong foundational literacy and numeracy (FLN) foundation equips individuals with the critical thinking skills needed to navigate cyber risks.

Prioritizing Education Systems

Countries that prioritize quantitative topics in their education systems tend to have higher cyber risk literacy.

Oliver Wyman Forum findings indicate that effective cyber risk education is rooted in strong foundational literacy

Weightage and Influence

Public Motivation (30%), Educational System (20%), and Government Policy (25%) cumulatively contribute to 75% of the overall index score.

The insights in Oliver Wyman Report indicate that Strong policy-driven education systems improve public motivation with respect to navigating cyber security risks.

Therefore, using FLN scores as a proxy for cyber risk literacy in the Indian Context is justified by the strong link between foundational education and cyber risk understanding.

Category wise ranking - Index on Foundational Literacy and Numeracy

Tap on a state to see details.

Key Findings:

Bihar & Uttar Pradesh have low FLN scores.

BIHAR

36.81

UTTAR PRADESH

38.46

TOTAL COMPLAINTS

239,576

AVERAGE COMPLAINTS

119,788

TOTAL AMOUNT

Rs 964.35 Crores

These states have the lowest FLN scores and report the highest number of cyber financial complaints and significant amounts of fraud, indicating higher vulnerability.

West Bengal and Kerala have high FLN scores.

WEST BENGAL

58.95

KERALA

67.95

TOTAL COMPLAINTS

53,561

AVERAGE COMPLAINTS

26,780

TOTAL AMOUNT

Rs 449.13 Crores

These states have high FLN scores and report fewer complaints and lower amounts of fraud, suggesting better resilience against cyber financial crimes.

The analysis underscores the significant correlation between foundational literacy and Cyber Risk Literacy, which directly impacts the vulnerability to cyber financial crimes. States with higher foundational literacy scores are less susceptible to such threats.

Clear communication, assurances of data deletion upon request, and education about customer rights significantly enhance trust in financial institutions

64%

customers have an increased trust in the companies which provide clear information

>70%

customers have an increased trust in the companies which provide clear information

IBM

Only 41%

organisations mentioned data principal rights

43%

organisations do not provide well-defined purposes for which personal data is shared with data processors for processing

The six dimensions of trust

India’s Account Aggregator (AA) ecosystem, often referred to as the UPI of data, is gaining significant traction. With 1.1 billion AA-enabled accounts and over 2.05 million users voluntarily sharing their financial data, the potential for AA is enormous. Current penetration is at 0.2%, but the annual transaction volume is expected to reach 1 billion by 2025 and 5 billion by 2027, according to Sahamati.

To ensure trust and sustainability, AAs must integrate the six dimensions of trust:

Security

Accountability

Transparency

Auditability

Fairness

Ethics

As AA volumes soar, incorporating these six dimensions of trust is essential. Addressing the gaps identified in Silence Laboratories’ survey around privacy, transparency, and auditability of consent mechanisms would be crucial for sustainable and secure growth.

Risks of Ignoring Cybersecurity and Cyber Risk Literacy in India's Financial Hypergrowth

The table below draws a parallel between the challenges faced in achieving financial inclusion and those currently hindering financial data privacy. Just as technological solutions like UPI and Aadhaar successfully addressed barriers to financial inclusion, adopting Privacy Enhancing Technologies (PETs) could similarly tackle the challenges in data privacy, ensuring a secure and resilient digital ecosystem.

Supply and Demand Side Challenges

Low literacy and lack of collateral

Absence of a universal identity solution for all citizens, regardless of educational background

Trust issues while transacting with digital money

Low cyber risk literacy

Awareness gaps of new age risks

Absence of cybersecurity solutions accessible to all citizens, irrespective of their level of cyber literacy

Regulatory Hurdles

Stringent bank requirements

Difficult onboarding

Complex data protection needs

Rising cybercrimes

Technological Solutions

UPI and Sahamati platforms

UIDAI (Aadhaar) for uniform identity

Privacy Enhancing Technologies (PETs)

Transparent, auditable & programmable consent

Impact

Easy onboarding

Access to safe credit and savings

Secure financial data

Resilient digital infrastructure

The Cost of Delaying Tech Adoption

Consider the impact if UPI and Aadhaar had been delayed—India’s rapid economic growth might not have materialized at the same scale. UPI alone has saved the Indian economy approximately $67 billion since 2016. A delay could have cost the nation billions, potentially stalling its rise to the 5th largest economy by 2022.

Similarly, Privacy Enhancing Technologies (PETs) are crucial for addressing current data privacy challenges. However, delays in their adoption could lead to escalating economic losses due to rising cybercrimes, which already resulted in over 1.14 million attacks and 7400 Crores INR in losses in the financial sector alone.

Interconnected Risks in a Hyperconnected World

A report by WEF suggests that, In our interconnected digital world, the risks posed by cyber threats are amplified. Unlike biological viruses, cyber viruses are more potent, spreading rapidly and uncontrollably. For instance, while COVID-19’s R0 is between two and three, the R0 for cyberattacks can exceed 27. The 2017 WannaCry attack crippled over 200,000 computers across 150 countries in a single day.

If not addressed urgently, these cyber threats could trigger a domino effect, compromising critical growth engines like UPI and Open Banking as financial crimes scale from targeting individuals to threatening entire institutions and sovereign infrastructure.

Estimated Regulatory Lag in Cyber Risk Regulation & Awareness Across Countries

Understanding Factors Influencing Cyber Risk Regulation

Government Policy

SUPPLY SIDE

DIRECT IMPACT

Government policies directly set the regulatory framework for cybersecurity.

The speed and effectiveness of these policies directly influence regulatory lag.

Educational System

SUPPLY SIDE

INDIRECT IMPACT

Integrates cyber risk literacy into formal education.

Produces knowledgeable individuals who advocate for stronger, timely regulations, indirectly reducing regulatory lag.

Labor Market

SUPPLY SIDE

INDIRECT IMPACT

Measures employer demand for cybersecurity skills.

High demand highlights the need for up-to-date regulations to protect businesses, indirectly influencing regulatory speed.

Public Motivation

DEMAND SIDE

INDIRECT IMPACT

Reflects public awareness and proactive behavior towards cybersecurity.

High public demand can push governments to expedite regulatory updates, indirectly reducing regulatory lag.

Population Inclusivity

DEMAND SIDE

INDIRECT IMPACT

Ensures equal access to digital technologies and education.

Inclusive policies ensure all demographics are considered in regulations, indirectly reducing lag by addressing comprehensive needs.

Estimating regulatory gaps

High Tech Business Vs US Government

9x regulatory gap

In 2011, Eric Schmidt, then CEO of Google, echoed former Intel CEO Andy Grove’s sentiment, highlighting a critical challenge:

"High tech runs three times faster than normal businesses, and the government runs three times slower than normal businesses. So we have a nine-times gap.”

Schmidt’s perspective underscores a fundamental issue—technology advancements occur at a pace that far outstrips the ability of regulatory frameworks to keep up. Google, recognizing this discrepancy, sought to shield itself from the sluggish pace of democratic institutions

The Indian Context

Based on Andy Grove's formula, if advanced countries like USA experience a 9x regulatory lag, then India, which ranks 45th in cyber risk literacy, would experience a regulatory lag proportion of 40.5 x. This disparity is not just a multiple of the difference in rankings but also reflects the compounded effect of lower public motivation, weaker government policy, less effective educational systems, a less responsive labor market, and lower population inclusivity.

% of financial regulators seeking a solution but not planned yet

Interdepartmental data

(e.g. stacking market conduct supervision data with prudential supervision data)

43%

Cross-entity analytics

stacking multiple data sources

43%

Alternative dispute resolution

37%

Detect algorithmic bias/error

37%

Terms and conditions, privacy policy, and consent management data

34%

Causes of the mismatch in demand and supply of RegTech /SupTech

There is a significant disconnect between financial authorities and technology innovators regarding the development and implementation of RegTech (Regulatory Technology) and SupTech (Supervisory Technology) solutions. This mismatch stems from various challenges faced by both parties as illustrated in the figure.

Unaware of solutions that are available or how to find them

Not aware of demands or needs of financial authorities

Lack resources, advice, or technical assistance

May perceive regtech for regulators as too small a market

Legacy or non-existent IT systems & processes

Discouraged by burdensome processes

Unable to express their needs to vendors in an easily understandable way

Lack of clarity on technical parameters & requirements

Limited collaboration across departments & agencies to share tools & data

Not accustomed to engaging with financial authorities

Regulatory Lag & the role of PETs

Based on Andy Grove’s formula and cyber risk literacy rankings, advanced countries like the USA experience a 9 x regulatory lag, while India faces a 40.5 x lag due to lower cyber risk literacy.

With increasing demand for personalised services and the recent introduction of DPDP Act in India, businesses struggle in managing regulatory requirements, and may inadvertently attract penalties for non-compliance.

Some ways to ensure compliance include

Regulators should communicate clear interpretation of laws and actionable steps for businesses

Advocacy of privacy based technologies and “privacy by design” by regulatory bodies

Adoption of RegTech and SupTech solutions by businesses to ensure compliance

The onus of compliance should not be blindly placed on trust between organisations or legal agreements, but by embedding policy as a code. Such programmability could be enabled by Privacy Enhancing Technologies (PETs), cryptographic tools which can unlock collaboration on siloed data, ensuring privacy and compliance with regulatory requirements

BRIDGING THE GAPS

The research highlights the inadequacy of simply informing users about data sharing practices. Instead, financial institutions need to move towards a model that empowers users with genuine control over their data. This shift can be achieved through clear and concise communication, offering granular consent options, and providing user-friendly tools for managing data access and revoking consent.

CLEAR, EXPLICIT, AND GRANULAR CONSENT

Empowering users with refined understanding & control over what data is shared and for what purpose through detailed yet lucid consent notices and forms at the time of signup

TRANSPARENCY BEYOND CONSENT

Providing unambiguous, sincere, and proactive communication about terms of data collection, storage, and usage including details of data sharing, duration of storage, and access procedures

EASY-TO-ACCESS CONTROL OPTIONS

Providing readily-available user-friendly mechanisms for revoking consent and conveniently managing data access whenever they desire

DEMONSTRATING VALUE

Illustrating and exemplifying clearly how more collected data translates to better products and services through distinctly enhanced user experience

PARTICIPATIVE DECISION-MAKING

Continuously interacting with users, keeping them informed of changes, eliciting & incorporating their opinion, & fostering a dialectical developmental ecosystem

Customer education

A cornerstone to building trust

The user-centric approach begins with the education of the customer

What are the rights which they have, and how can they exercise them

How privacy differs from consent mechanisms

or security measures, and its relevance for them

What terms of data sharing should they look out for, and the importance of control over their data

Marrying consent with compute

From contractual trust to mathematical guarantees

Prevention of data misuse is key to building customer trust. Consent given for a particular purpose should ensure data is being processed for the same, and provide verifiable mechanisms to audit as well. However, trust on third parties or legal contracts should not simply alleviate privacy concerns. Instead, the ability to only process what is consented should be programmed in the consent mechanisms.

Leveraging Technology

Secure and Transparent Data Sharing

Technological advancements offer powerful tools to ensure secure and transparent data processing practices. Privacy-preserving technologies like Multi-Party Computation (MPC) can unlock data-driven insights without compromising user privacy. Ensuring zero movement of data in its raw form and eliminating the risk of single point of failure enabled by such technologies could revolutionize collaborations with utmost respect to privacy.

CONCLUSION

Building a secure, streamlined, synergistic, and sustainable financial data sharing ecosystem is a shared responsibility, requiring collaborative effort from all stakeholders.

Financial institutions must prioritize transparency, provide user-centric control mechanisms, and utilize privacy-preserving technologies. Regulatory bodies need to establish a balanced framework that facilitates innovation while safeguarding privacy and other user rights. Finally, user education efforts are crucial to empower individuals to understand their data rights, develop a keen sense of discernment for data sharing, and make informed decisions about their data.

Although the aforementioned insights were derived in the context of financial institutions, they also broadly capture key general trends in user attitudes which would be of relevance to any industry. Industries must move beyond merely informing users about data sharing to empowering them with genuine control.

Observing the distinction and interrelationship between privacy, security, consent and control in thought,

communication, and practice would benefit all stakeholders and enable the world’s most populous country to harness the full potential of data, the fuel of the future.